Tax compliance is a challenging undertaking for a business of any size. Regulations are changing constantly at local, state, and federal levels. Business relationships with suppliers and customers undergo similar changes regularly. All of this ties into how tax liability is organized, calculated, and addressed. Streamlined sales tax can deliver the answers your business needs with ease.

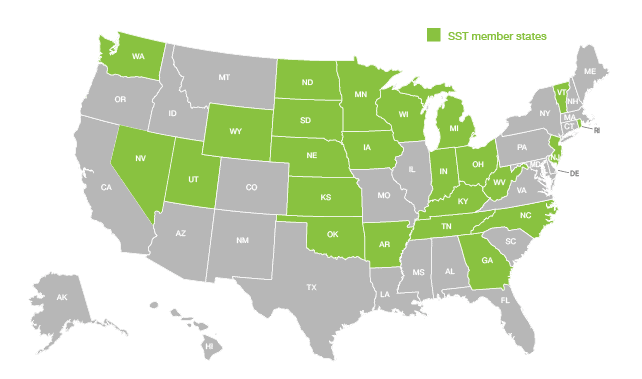

Now, what would you say to an offer that included all of these services and more, for free? Kind of a no-brainer, right? Well, if your company does business in one of the 24 member states, you can take advantage of this special program, free of charge. Click here to get started.

Take advantage of free:

- State registrations

- Tax calculations

- Tax returns preparation, filing, and remittance

- Audit assistance.

Streamlined Sales Tax Agreement Details

Here’s how you can apply at no cost to your business. The Agreement enables participating states to simplify and modernize sales tax administration, to substantially reduce the tax compliance burden. As one of only a few certified SST service providers, our partners at Avalara perform the above tasks. The states pay Avalara for the services and qualifying businesses get them for free.

Contact Encompass Solutions, Inc. using the link below to start the qualification process.

About Streamlined Sales Tax Governing Board Inc.

The effort that became the Streamlined Sales Tax Governing Board began in March 2000. The goal of this effort is to find solutions for the complex in-state sales tax systems that resulted in the U.S. Supreme Court holding (Bellas Hess v. Illinois and Quill Corp. v. North Dakota) that a state may not require a seller that does not have a physical presence in the state to collect tax on sales into the state. The Court ruled that the existing system was too complicated to impose on a business that did not have a physical presence in the state. The Court said Congress has the authority to allow states to require remote sellers to collect tax.

The result of this work is the Streamlined Sales and Use Tax Agreement. This Agreement simplifies and modernizes sales and uses tax administration to substantially reduce the burden of tax compliance. The Agreement focuses on improving sales and uses tax administration systems for all sellers and all types of commerce through all of the following:

- State-level administration of sales and use tax collections.

- Uniformity in the state and local tax bases.

- Uniformity of major tax base definitions.

- A central, electronic registration system for all member states.

- Simplification of state and local tax rates.

- Uniform sourcing rules for all taxable transactions.

- Simplified administration of exemptions.

- Simplified tax returns.

- Simplification of tax remittances.

- Protection of consumer privacy.

Today twenty-four states have adopted the simplification measures in the Agreement (representing over 31 percent of the population) and more states are moving to adopt the simplification measures.

About Avalara

Experts in all things revolving around tax compliance, Avalara makes tax compliance easy and efficient. This enables you to do what you do best, without constantly worrying about rate changes or filing deadlines.

About Encompass Solutions

Encompass Solutions, Inc. is an ERP consulting firm, NetSuite Solution Provider, and Epicor Gold Partner that offers professional services in business consulting, project management, and software implementation. Whether undertaking full-scale implementation, integration, and renovation of existing systems or addressing emerging challenges in corporate and operational growth, Encompass provides a specialized approach to every client’s needs. As experts in identifying customer requirements and addressing them with the right solutions, we ensure our clients are equipped to match the pace of the Industry.